In the competitive Australian property market, making your home stand out to potential buyers can significantly affect its sale price.

Read MoreThis article delves into strategies for optimizing your superannuation investment mix, considering different career stages, the uniqueness of self-managed superannuation funds (SMSFs), and the benefits of integrating Environmental, Social, and Governance (ESG) investments into your portfolio.

Read MoreFinancial stress is a common issue that affecting more and more Australians. It can be particularly difficult when your income is not increasing at the same rate as inflation. This means that the cost of living is increasing, but your income is not keeping up.

Read MoreDeciding to buy an investment property is a major decision as it involves another financial commitment you need to meet. While it's a nice idea to own an investment property or two, knowing if you're ready to buy can be complicated as you need to factor in cost of unexpected expenses.

Read MoreLet’s explore why using mortgage brokers offer distinct advantages that can significantly benefit borrowers, with access to a wide range of lenders and expertise in navigating the complex mortgage landscape.

Read MoreIn this article, we will guide you through the process of finding and selecting the right mortgage broker for your specific requirements.

Read MoreWhen we need a home loan, regardless if it’s to purchase or refinance a property, we tend to go to our existing banks as we feel that we have a relationship with either the brand, branch and occasionally with particular staff members themselves.

Read MoreWith real estate agents increasingly encouraging sellers to take advantage of sellers’ market in-order to maximise their possible sale price, it’s no surprise sellers want to capitalise on bidder competition.

Read MoreWith the interest rates (cost) on offer for home loans at historically low levels, more and more borrowers are asking if they should fix their home loan and for how long?

Read MoreWe, Australians are a trusting bunch, even after the Banking Royal Commission in 2019 and the 2020 ACCC report on mortgages confirmed, what we all knew, banks don’t have our best interest at heart, most of us still stayed loyal and continue to miss out on a better financial outcome for our future selves.

Read MoreFor a savvy property buyer, good debt is any borrowed money which is used for investment purposes. Mind you, not just any investment i.e. buying part share is a greyhound syndicate doesn’t qualify as a good debt, the investment has to be income producing with a strong potential for capital growth over time.

Read MoreProperty owners regularly talk about using equity to build a property portfolio, but how do you actually get a hold of it?

Read MoreRegardless of what comes first albeit children, marriage or real estate if you’re over the age of 18 you need a Will.

Read MoreA home loan is usually the largest debt a person commits to during their lifetime, be it for a residential or an investment property purposes. Follow our tips to get the best interest rates for your home loan when refinancing.

Read MoreWhat should you be considering when looking to a property? Sometimes, it’s easy to get distracted by how a property looks or the colour scheme internally and external. Remember, if the property ticks all the boxes, hideous colour schemes can be painted over.

Read MoreAt loansHub, we make getting a mortgage simple, easy and stress-free as possible.

Read MoreWhether you are selling, refinancing and making that final mortgage repayment on your home loan, you will need to discharge your mortgage from the lender if you want them to release their caveat on your property.

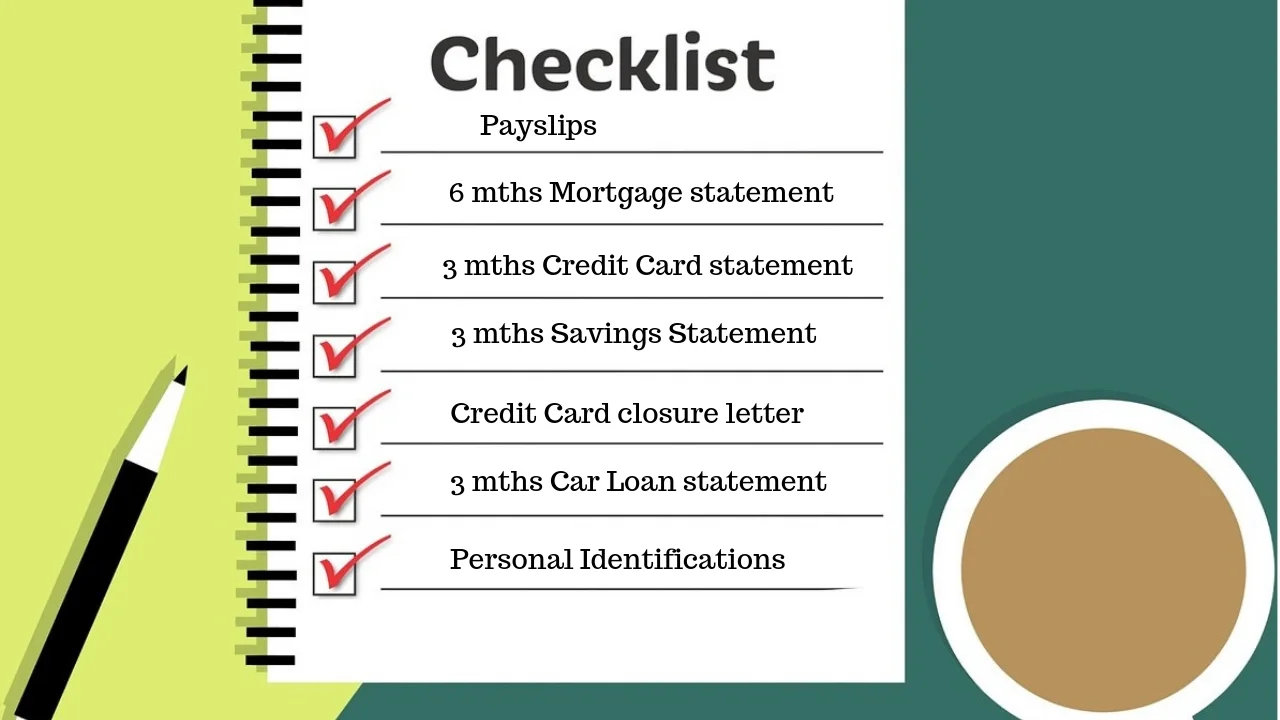

Read MoreMortgage applications typically require a lot of documents, loanshub.com.au request that the documents be uploaded during the application process to make your mortgage experience as efficient as possible.

Read MoreWith Australia moving towards an American styled open banking system, in the future, a good credit score will likely equate to getting a better interest rate with your home loan.

Read MorePaying off a mortgage early can save on interest, free up cash-flow each month and help you enjoy all the benefits of a debt-free lifestyle.

Read More