Coping with Financial Stress: Strategies for Dealing with Increasing Expenses

Financial stress can be overwhelming, especially when your income fails to keep up with inflation. Inflation erodes the purchasing power of your money, making it harder to cover everyday expenses and achieve your financial goals.

However, with careful planning, budgeting, and smart financial strategies, you can cope with these challenges and maintain your financial well-being. In this article, we will explore effective strategies to navigate financial stress when your income is not increasing at the same rate as inflation.

Assess your financial situation:

The first step in coping with financial stress is to evaluate your current financial situation. Take stock of your income, expenses, assets, and debts. This assessment will help you gain clarity on your financial standing, enabling you to make informed decisions.

Create a realistic budget:

Developing a realistic budget is crucial to managing your finances effectively. Start by tracking your expenses for a month to identify areas where you can cut back. Differentiate between essential and non-essential expenses, prioritising the former.

Allocate a portion of your income towards savings and emergency funds. Ensure your budget accounts for inflation, setting aside funds for anticipated price increases.

Prioritise debt management:

If you have outstanding debts, create a plan to tackle them strategically. Focus on high-interest debts first while making minimum payments on others. Explore options like debt consolidation or refinancing to potentially lower interest rates.

Consider seeking advice from a financial counsellor to develop a personalised debt repayment strategy.

Look for ways to reduce expenses

Reducing expenses is a key strategy for coping with financial stress when your income is not increasing at the same rate as inflation.

There are many ways to reduce expenses, such as negotiating lower rates for utilities, shopping for the best deals on groceries, and reducing or eliminating non-essential expenses. It is important to be creative and resourceful when looking for ways to reduce expenses.

Review and adjust your investments:

Revisit your investment portfolio to ensure it aligns with your financial goals and risk tolerance. Consider diversifying your investments to reduce risk.

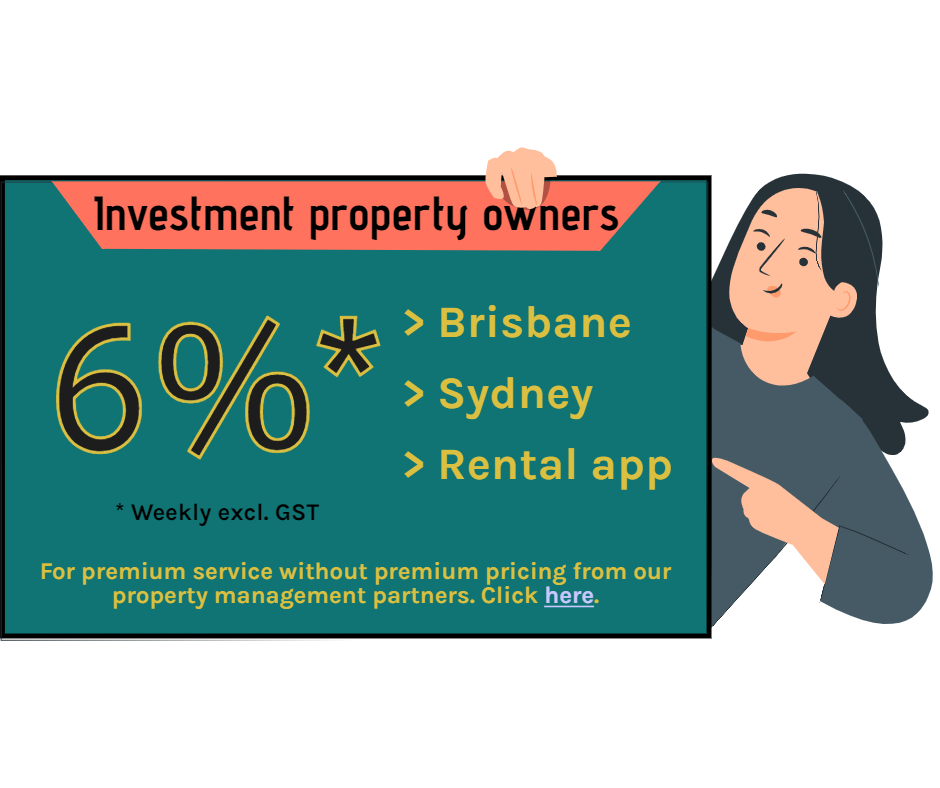

Speak to a financial advisor who can guide you through potential investment opportunities that offer protection against inflation. Real estate, inflation-indexed bonds, and stocks of companies with pricing power are worth exploring.

Enhance your financial literacy:

Educate yourself about personal finance and investing. The more you understand financial concepts, the better equipped you'll be to make informed decisions.

Read books, attend workshops, listen to podcasts, and follow reputable financial experts or blogs. Gaining financial knowledge empowers you to navigate economic challenges more effectively.

Negotiate expenses and seek discounts:

Don't be afraid to negotiate better deals for your recurring expenses such as utilities, insurance, or phone bills. Shop around for competitive rates and take advantage of loyalty programs or customer discounts. Being proactive can help you reduce costs and maximise your purchasing power.

Embrace frugal living:

Adopting a frugal lifestyle can significantly alleviate financial stress. Look for ways to save money in your daily life, such as meal planning, shopping in bulk, using coupons, and practicing energy efficiency at home.

Seek free or low-cost alternatives for entertainment and leisure activities, and focus on experiences rather than material possessions.

Build an emergency fund:

Creating an emergency fund is essential to prepare for unexpected expenses or income fluctuations. Aim to save at least three to six months' worth of living expenses in a separate account. Having a financial safety net provides peace of mind and protects you during challenging times.

Seek professional guidance:

If you find it challenging to cope with financial stress, consider seeking guidance from a certified financial counsellor. They can provide personalised advice tailored to your situation and help you develop a comprehensive financial plan, all free of charge!

Conclusion:

In conclusion, coping with financial stress when your income is not increasing at the same rate as inflation can be challenging.

However, by creating a budget, prioritizing expenses, reducing expenses, earning additional income, saving for emergencies, managing debt, and seeking financial advice, you can take control of your finances and reduce your financial stress.

Remember that it is important to be patient and persistent as you work towards improving your financial situation.