Whether you are upgrading your kitchen, adding an extra bathroom, or completely overhauling your property, financing your renovation the right way can save you thousands of dollars.

Read MoreThis article delves into the multifaceted role of mortgage brokers in the home loan process, highlighting their importance in ensuring a smooth and advantageous financing experience for borrowers.

Read MoreAs an Australian property owner or aspiring homebuyer, managing your finances effectively is crucial.

Read MoreFinancial stress is a common issue that affecting more and more Australians. It can be particularly difficult when your income is not increasing at the same rate as inflation. This means that the cost of living is increasing, but your income is not keeping up.

Read MoreDeciding to buy an investment property is a major decision as it involves another financial commitment you need to meet. While it's a nice idea to own an investment property or two, knowing if you're ready to buy can be complicated as you need to factor in cost of unexpected expenses.

Read MoreLet’s explore why using mortgage brokers offer distinct advantages that can significantly benefit borrowers, with access to a wide range of lenders and expertise in navigating the complex mortgage landscape.

Read MoreIn this article, we will guide you through the process of finding and selecting the right mortgage broker for your specific requirements.

Read MoreWhen we need a home loan, regardless if it’s to purchase or refinance a property, we tend to go to our existing banks as we feel that we have a relationship with either the brand, branch and occasionally with particular staff members themselves.

Read MoreWhether you are selling, refinancing and making that final mortgage repayment on your home loan, you will need to discharge your mortgage from the lender if you want them to release their caveat on your property.

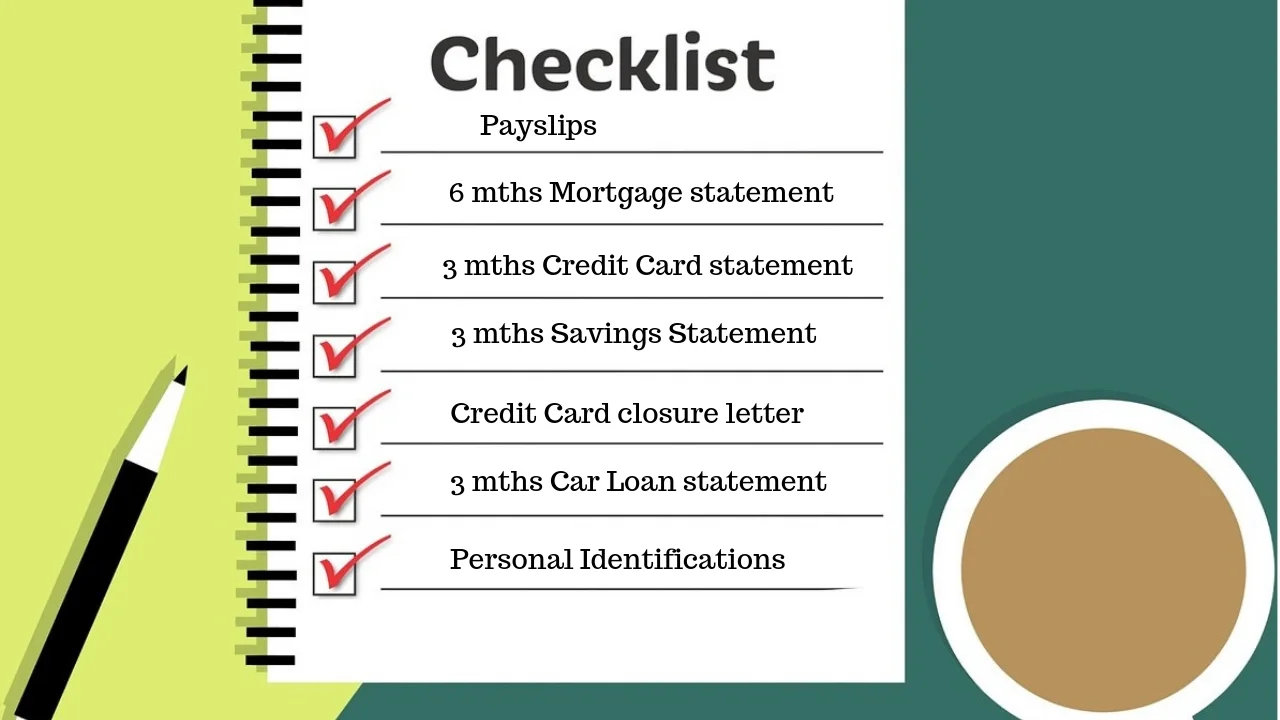

Read MoreMortgage applications typically require a lot of documents, loanshub.com.au request that the documents be uploaded during the application process to make your mortgage experience as efficient as possible.

Read MoreWith Australia moving towards an American styled open banking system, in the future, a good credit score will likely equate to getting a better interest rate with your home loan.

Read MorePaying off a mortgage early can save on interest, free up cash-flow each month and help you enjoy all the benefits of a debt-free lifestyle.

Read MoreIn today’s competitive home loan market second tier banks and mutual lenders are not only offering low rates on their home loan products in an attempt to increase their market share,

Read MoreIf you have a mortgage, you may have heard from your neighbours, on the news reports and even the federal treasurer talking about refinancing to get a better deal. Should you be considering it too?

Read More