Property owners regularly talk about using equity to build a property portfolio, but how do you actually get a hold of it?

Read MoreRegardless of what comes first albeit children, marriage or real estate if you’re over the age of 18 you need a Will.

Read MoreA home loan is usually the largest debt a person commits to during their lifetime, be it for a residential or an investment property purposes. Follow our tips to get the best interest rates for your home loan when refinancing.

Read MoreWhat should you be considering when looking to a property? Sometimes, it’s easy to get distracted by how a property looks or the colour scheme internally and external. Remember, if the property ticks all the boxes, hideous colour schemes can be painted over.

Read MoreAt loansHub, we make getting a mortgage simple, easy and stress-free as possible.

Read MoreWhether you are selling, refinancing and making that final mortgage repayment on your home loan, you will need to discharge your mortgage from the lender if you want them to release their caveat on your property.

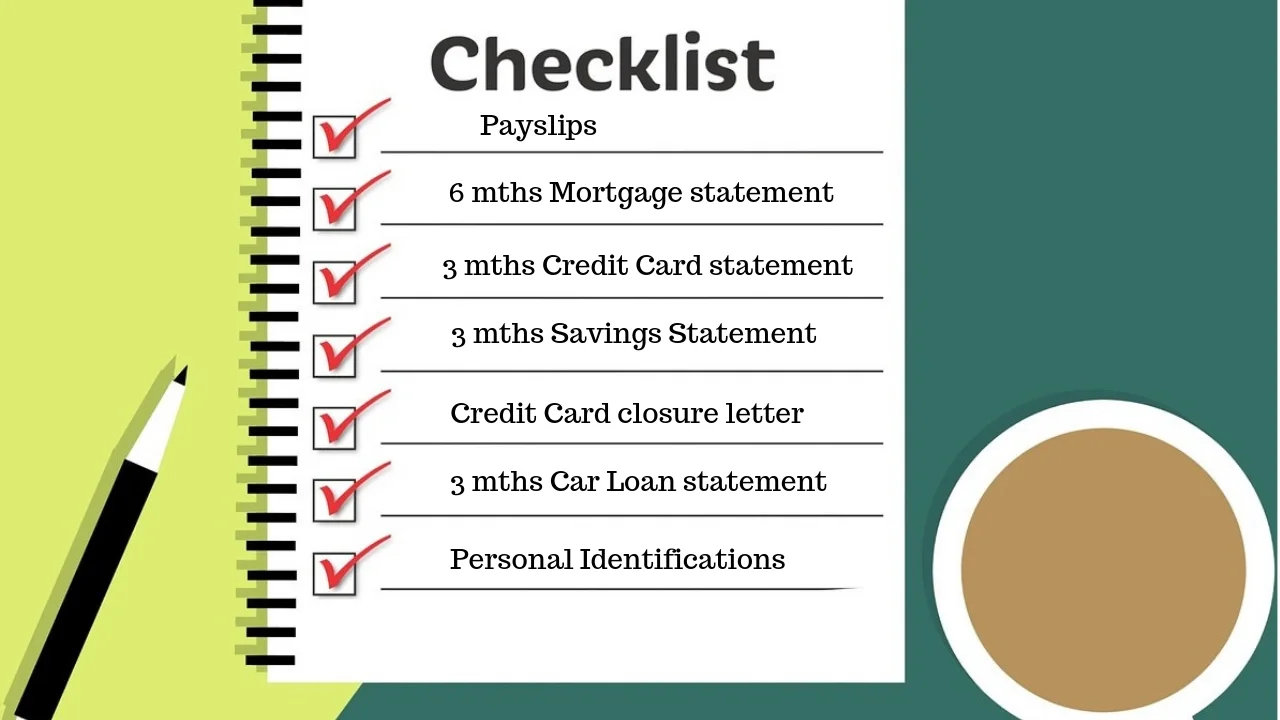

Read MoreMortgage applications typically require a lot of documents, loanshub.com.au request that the documents be uploaded during the application process to make your mortgage experience as efficient as possible.

Read MoreWith Australia moving towards an American styled open banking system, in the future, a good credit score will likely equate to getting a better interest rate with your home loan.

Read MorePaying off a mortgage early can save on interest, free up cash-flow each month and help you enjoy all the benefits of a debt-free lifestyle.

Read MoreSmall businesses can always benefit from an upgrade to existing equipment or from purchasing the very latest technology or machinery.

Read MoreWhether you’re thinking about purchasing an existing home, renovating a current home or looking at building a new home, you will need to do some essential planning to ensure the best outcome.

Read MoreWhether you are a first-time home buyer or a seasoned home owner purchasing a new home or investment property, we have gathered a few buying tips to help you make the best choices during your journey:

Read MoreFar too many small businesses fail to keep on top of their cash flow and this inevitably leads to the business failing.

Read MoreTo get a clearer view of the mortgage process, it’s helpful to know some of the factors that will be considered when your mortgage application is reviewed.

Read MoreThe Federal government has announced that they will be placing the Banking Royal Commission’s recommendation on ‘trail’ commissions on the back burner for at least 3 years

Read MoreA small business loan can be invaluable when you’re establishing your business or when an unforeseen setback occurs, but you don’t want a loan to be short-term gain and long-term pain.

Read MoreComparison rates take the hard work out of comparing the cost of different loans, but they are not the only thing to consider when you're shopping around for a loan.

Read MoreThanks to government efforts to accelerate home ownership and boost the homebuilding industry, first home buyers are now eligible for grants and subsidies.

Read MoreHere we look at the main differences, the most popular loan types, and how to get the best mortgage for your situation. Interest-only, fixed, variable, offset – finding the investment home loan that’s right for you can seem like a minefield of financial jargon and conditions.

Read MoreThere are several types of commercial and asset finance, so make sure you know the differences. Then you can decide which one will suit you.

Read More