How to invest in real estate to make money

Investing in real estate requires time, patience, cash and most importantly you having the financial capacity to service the debt.

You probably shouldn't consider investing in real estate until you, have accumulated emergency funds, have little or no consumer debt, and either have significant equity in an existing property or a large pool of savings to use as deposit and pay cost of purchase.

While there are options for novice investors to get into real estate, the big returns are found in the long term investments like, buying and accumulating a multi-property portfolio or short holdings like fixing up a family homes and selling it for a profit (aka flipping).

As with any investment, bigger returns can also mean bigger risk of incurring a loss. With that in mind, here are a few considerations when investing in real estate with the aim of building long term wealth:

1. First, get your finances in order

Before getting in to any type of real estate investment, get the rest of your financial house in order — establish an emergency fund, pay off consumer debt, and check your borrowing power.

Real estate is a particularly expensive investment, so you need to have cash on hand or sufficient equity to use as deposit and also, one you buy an investment, a reserve to dip into if and when something needs fixing, which should be entirely separate from your everyday emergency fund.

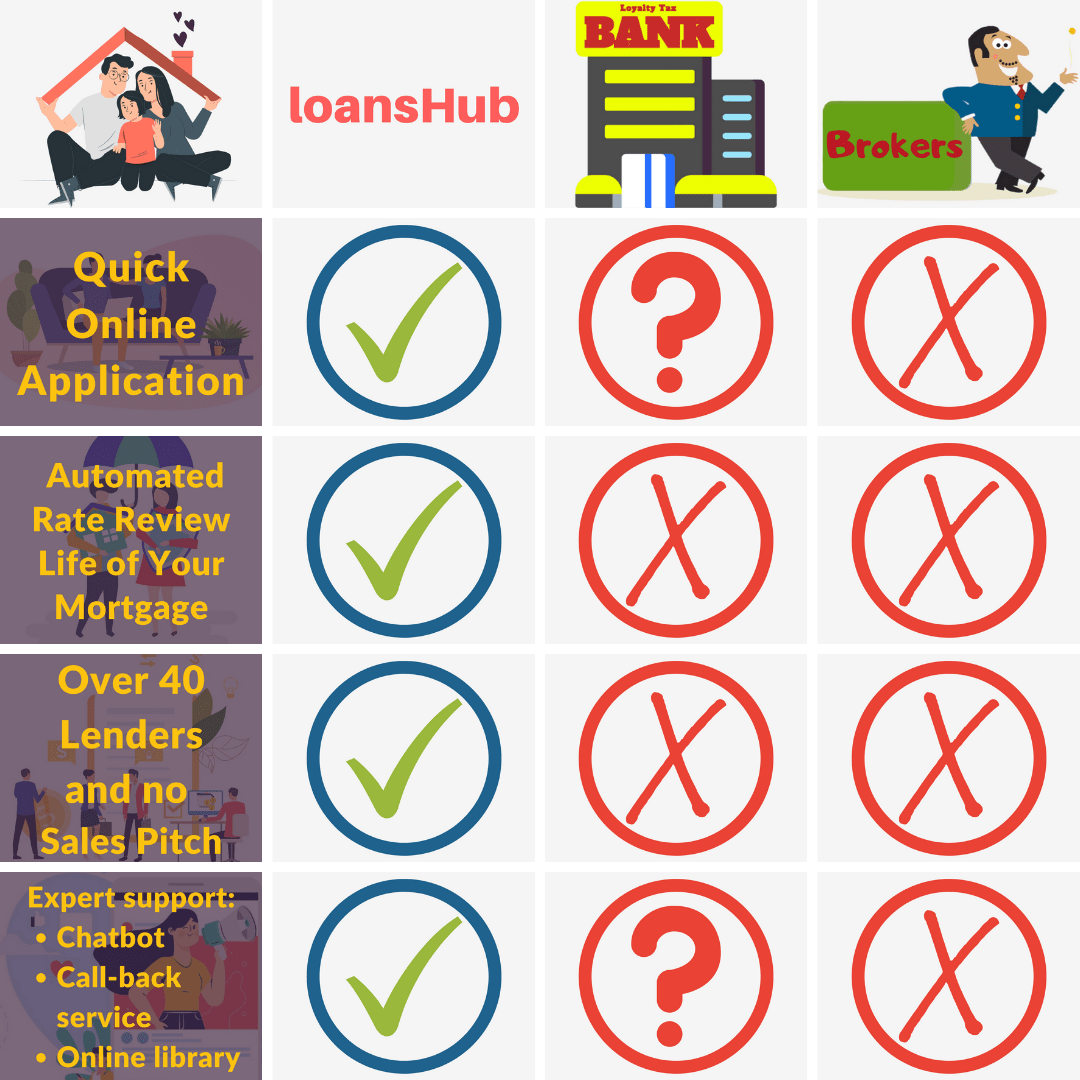

Check how your home loan compares

2. Get to know the local housing market

If you do plan on buying your own investment property, start by getting to know the local market you’re interested to buying into.

Talk to local real estate agents; find out who lives in the area, who is moving to the area, and why; and analyse price history. In short: Do your research.

3. Build a local team

Successful real estate investing is as much about what you know as who you know. If you really want to get into real estate investing, you need to focus on building relationships with people — because that's what real estate is, it's a relationship-based business.

Build a team of real estate agents, tradies, conveyancers, and accountants who can all help your property investment business run smoothly.

4. Keep it simple

A simple strategy can go a long way in real estate investing. If your goal is to generate passive income, don't be fooled into believing you need to go big to make it happen.

It's best to start small and keep your expenses low, the game of rental properties is eventually getting it free and clear of debt, so that you have a very low-risk, high-income investment that allows you to leave your job or have a little independence to do other things.

5. Positive gearing is best

Buying a property and renting it out will only generate income if overhead costs are low. If your tenant's rental payment doesn't cover the mortgage, rates, land taxes, and maintenance, you're effectively losing money.

Ideally, your monthly mortgage payment is always less than your rental income, which will increase the amount of money you pocket over time as rent prices rise.

6. Try 'house-stacking'

One way to buy investment property and maximise your borrowing power is by what I like to call, house stacking.

For this strategy to work, you need to live in an area where duplexes are permitted. The idea is to buy both units in a duplex and live in one unit and rent out the other.

This cuts down your own living expenses and will potentially generate enough rental income to cover more than half of your total mortgage payment.

7. Buy a fixer upper and flip it

While the fixer upper strategy has been glorified by renovation shows on TV, it remains one of the most time-consuming and costly ways to invest in real estate — but it also has the potential to produce the biggest gains.

Buying a home, renovating it, and reselling it can be a hit or a miss. You should always be prepared for unexpected problems, budget increases, time-inducing mistakes, a longer renovation timeline, and issues selling on the market.

To ensure that your property investments will make you money, it's important to build a team of experts you can trust and make sure you have enough cash reserves to carry you through any financial shortfalls.

Tell us: Enjoyed this article? Don’t forget to like and share.

And while you’re here, take our mortgage shredder challenge and discover how much you can save on your home and investment loans by using loansHub technology as your personal mortgage manager. To discover why loansHub and what we do, click here.

This article does not constitute advice; readers should seek independent and personalised counsel from an appropriate trusted adviser that specialises in property, a tax accountant and property or interior design specialist.